Why Are Futures Not Securities . Futures are traded in commodities, currencies, interest rate changes, oil and gas, securities, and much more. Please read the risk disclosure. Futures are agreements that make you buy or sell something at a fixed price on a future date. You can use them to bet. These hedgers offset risks in their operations that could significantly swing revenues and expenditures if left unprotected from. They each may offer returns on your. Futures and stocks are two of the major classes of financial assets available to retail investors. Futures and futures options trading involves substantial risk and is not suitable for all investors. Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others tend to see derivatives as.

from www.slideserve.com

Please read the risk disclosure. You can use them to bet. Futures are agreements that make you buy or sell something at a fixed price on a future date. These hedgers offset risks in their operations that could significantly swing revenues and expenditures if left unprotected from. They each may offer returns on your. Futures and stocks are two of the major classes of financial assets available to retail investors. Futures are traded in commodities, currencies, interest rate changes, oil and gas, securities, and much more. Futures and futures options trading involves substantial risk and is not suitable for all investors. Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others tend to see derivatives as.

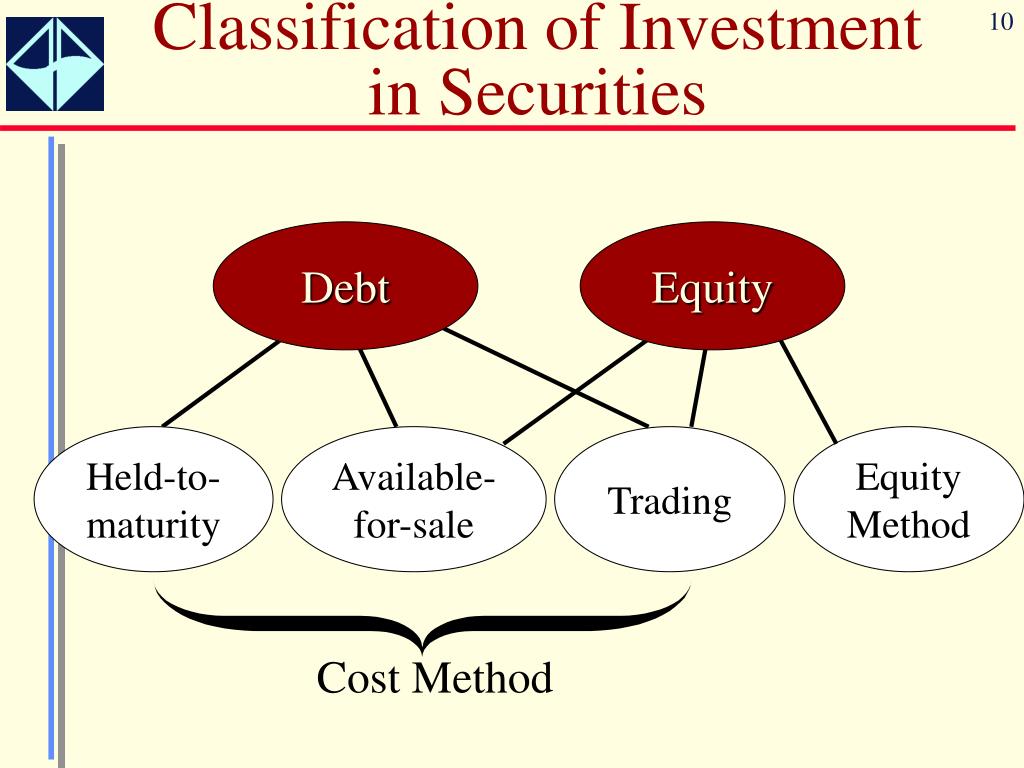

PPT Investment in Debt and Equity Securities PowerPoint Presentation

Why Are Futures Not Securities Futures are traded in commodities, currencies, interest rate changes, oil and gas, securities, and much more. Futures and stocks are two of the major classes of financial assets available to retail investors. You can use them to bet. Futures are traded in commodities, currencies, interest rate changes, oil and gas, securities, and much more. These hedgers offset risks in their operations that could significantly swing revenues and expenditures if left unprotected from. They each may offer returns on your. Futures are agreements that make you buy or sell something at a fixed price on a future date. Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others tend to see derivatives as. Please read the risk disclosure. Futures and futures options trading involves substantial risk and is not suitable for all investors.

From stocksbrowser.com

Common Examples of Marketable Securities Stocks Browser Why Are Futures Not Securities Futures are traded in commodities, currencies, interest rate changes, oil and gas, securities, and much more. These hedgers offset risks in their operations that could significantly swing revenues and expenditures if left unprotected from. Please read the risk disclosure. Futures and stocks are two of the major classes of financial assets available to retail investors. You can use them to. Why Are Futures Not Securities.

From www.simonoregan.com

Principles of Futures Thinking — Simon O'Regan Why Are Futures Not Securities Futures and stocks are two of the major classes of financial assets available to retail investors. These hedgers offset risks in their operations that could significantly swing revenues and expenditures if left unprotected from. Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others tend to see derivatives. Why Are Futures Not Securities.

From vajiramias.com

Recently, the Securities and Exchange Board of India (SEBI) has asked Why Are Futures Not Securities These hedgers offset risks in their operations that could significantly swing revenues and expenditures if left unprotected from. You can use them to bet. Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others tend to see derivatives as. Futures and futures options trading involves substantial risk and. Why Are Futures Not Securities.

From www.happiestpost.com

Futures and options Why Are Futures Not Securities You can use them to bet. Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others tend to see derivatives as. They each may offer returns on your. Please read the risk disclosure. Futures and stocks are two of the major classes of financial assets available to retail. Why Are Futures Not Securities.

From www.pinterest.com

Futures and Forwards Financial life hacks, Learn accounting Why Are Futures Not Securities Futures and stocks are two of the major classes of financial assets available to retail investors. Futures are agreements that make you buy or sell something at a fixed price on a future date. These hedgers offset risks in their operations that could significantly swing revenues and expenditures if left unprotected from. Please read the risk disclosure. You can use. Why Are Futures Not Securities.

From www.institutionalinvestor.com

The MortgageBacked Securities Market Faces New Challenges Why Are Futures Not Securities Futures are traded in commodities, currencies, interest rate changes, oil and gas, securities, and much more. Futures and stocks are two of the major classes of financial assets available to retail investors. You can use them to bet. Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others. Why Are Futures Not Securities.

From www.slideserve.com

PPT Investment in Debt and Equity Securities PowerPoint Presentation Why Are Futures Not Securities Futures and futures options trading involves substantial risk and is not suitable for all investors. Futures are traded in commodities, currencies, interest rate changes, oil and gas, securities, and much more. Futures and stocks are two of the major classes of financial assets available to retail investors. Most seem to know that the financial crisis of 2008 was based, at. Why Are Futures Not Securities.

From rmoneyindia.com

Learn about futures & options derivative contracts in India Why Are Futures Not Securities These hedgers offset risks in their operations that could significantly swing revenues and expenditures if left unprotected from. Futures are agreements that make you buy or sell something at a fixed price on a future date. Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others tend to. Why Are Futures Not Securities.

From www.pinterest.com

You might have been interested in learning why futures and options are Why Are Futures Not Securities Futures are agreements that make you buy or sell something at a fixed price on a future date. They each may offer returns on your. Futures and futures options trading involves substantial risk and is not suitable for all investors. Futures and stocks are two of the major classes of financial assets available to retail investors. Futures are traded in. Why Are Futures Not Securities.

From www.chegg.com

Solved Shown below are the Taccounts relating to equipment Why Are Futures Not Securities Futures and stocks are two of the major classes of financial assets available to retail investors. Futures are agreements that make you buy or sell something at a fixed price on a future date. You can use them to bet. They each may offer returns on your. Please read the risk disclosure. Futures are traded in commodities, currencies, interest rate. Why Are Futures Not Securities.

From www.facebook.com

Trading in Futures on Individual Securities stock, security Today Why Are Futures Not Securities Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others tend to see derivatives as. You can use them to bet. Please read the risk disclosure. These hedgers offset risks in their operations that could significantly swing revenues and expenditures if left unprotected from. They each may offer. Why Are Futures Not Securities.

From www.slideserve.com

PPT Investment in Debt and Equity Securities PowerPoint Presentation Why Are Futures Not Securities Futures are traded in commodities, currencies, interest rate changes, oil and gas, securities, and much more. Please read the risk disclosure. Futures and futures options trading involves substantial risk and is not suitable for all investors. Futures are agreements that make you buy or sell something at a fixed price on a future date. You can use them to bet.. Why Are Futures Not Securities.

From db-excel.com

Futures Trading Journal Spreadsheet in Futures Trading Spreadsheet Why Are Futures Not Securities Please read the risk disclosure. You can use them to bet. They each may offer returns on your. Futures and stocks are two of the major classes of financial assets available to retail investors. These hedgers offset risks in their operations that could significantly swing revenues and expenditures if left unprotected from. Most seem to know that the financial crisis. Why Are Futures Not Securities.

From www.tradethetechnicals.com

What Is Options Trading And How To Trade Options Why Are Futures Not Securities Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others tend to see derivatives as. You can use them to bet. They each may offer returns on your. Futures are agreements that make you buy or sell something at a fixed price on a future date. Futures are. Why Are Futures Not Securities.

From branditechture.agency

Download Securities and Futures Logo PNG and Vector (PDF, SVG, Ai, EPS Why Are Futures Not Securities Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others tend to see derivatives as. Futures are traded in commodities, currencies, interest rate changes, oil and gas, securities, and much more. Futures and futures options trading involves substantial risk and is not suitable for all investors. Futures are. Why Are Futures Not Securities.

From www.pinterest.com

Futures vs Options Investment quotes, Future options, Futures contract Why Are Futures Not Securities You can use them to bet. Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others tend to see derivatives as. Futures are traded in commodities, currencies, interest rate changes, oil and gas, securities, and much more. Futures and stocks are two of the major classes of financial. Why Are Futures Not Securities.

From www.chegg.com

Solved There are two future states and three securities with Why Are Futures Not Securities Futures and futures options trading involves substantial risk and is not suitable for all investors. Please read the risk disclosure. You can use them to bet. Most seem to know that the financial crisis of 2008 was based, at least in part, on the derivatives market, but others tend to see derivatives as. Futures are agreements that make you buy. Why Are Futures Not Securities.

From fabalabse.com

What are the 10 best investments right now? Leia aqui What is the Why Are Futures Not Securities Futures are traded in commodities, currencies, interest rate changes, oil and gas, securities, and much more. Please read the risk disclosure. Futures are agreements that make you buy or sell something at a fixed price on a future date. These hedgers offset risks in their operations that could significantly swing revenues and expenditures if left unprotected from. They each may. Why Are Futures Not Securities.